Get bucks to fairly share your thoughts toward items which have UserTesting. With a bit of time, you could potentially ultimately secure to $60 per sample.

Enterprises utilize UserTesting for their products looked at immediately by its address group. There is certainly a catch: so you’re able to attempt issues, you ought to be within the profit otherwise They.

۳۹. Rent out Parking having Pavemint

From inside the an enormous urban area, it is estimated that automobiles discharge doing dos.5 mil a lot of Carbon-dioxide annually just while they research to have vehicle parking.

Pavemint helps you manage that. Record their vehicle parking destination (home-based or business) to own an enthusiastic hourly otherwise each day price to see the cash rapidly sound right.

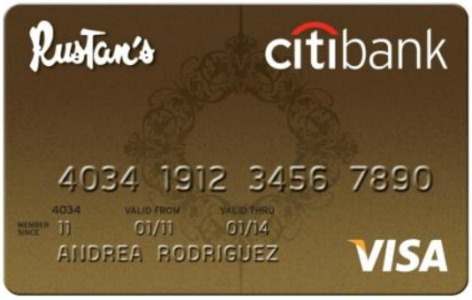

۴۰. Score an advance loan ?

The mastercard has a credit limit, however, do you realize you have the solution to withdraw an excellent percentage of those funds as dollars? Enter: the financing card payday loans.

While they’re best for fast bucks, they do have a higher-than-normal interest rate. Actually, rates having a cash loan are usually twenty four%.

Cash advances are considered to-be one type of “disaster mortgage”; keep reading to learn about almost every other mortgage versions and you can those that to stop.

If you’re within the a strict place financially, you may be wanting to know if finance are the best option to help you rating fast cash.

Disaster fund: This can be an excellent blanket title for your fast mortgage familiar with purchase crisis costs. These may incorporate payday loans, unsecured loans, cashback improves, and.

Read on more resources for which timely money choices you would be to end (especially if loans Billingsley AL you have a less than perfect credit score)

Money Errors to cease

When you are struggling to find bucks, you can build a few missteps. Here are a few of your own worst things to do from inside the this example:

step 1. Payday loans

Pay day loan is advances against your own income. Even though this audio harmless, the attention prices try substantial: usually a whopping 391%!

Not merely do predatory pay check loan providers target people who have poor credit ratings, cash advance are expensive and you can a big chance.

- Pay day loan was paid in you to definitely lump sum and generally due in full on the borrower’s second pay check.

dos. Borrowing Up against Retirement

Basic, you’ll receive twice-taxed in it given that you have already reduced taxes for the currency deposited, then it’s taxed once again when withdraw it. Second, while less than many years 59, you can also find struck having an excellent ten% very early delivery penalty.

۳. Taking out fully an extra Financial

Plus, they truly are risky. For those who end and make repayments, your lender you’ll foreclose even if you still have numerous security left with it.

Fundamentally, you can spend attract, which you have so you’re able to tack on to one monthly premiums when you are nevertheless purchasing very first financial.

cuatro. Racking up Personal credit card debt

When your credit rating are satisfactory, you could discover a credit card and commence using it almost immediately. But it’s very easy to dish right up loans.

- Usually do not fret out! Everybody has been through episodes in which our very own money was a great clutter. Perhaps it absolutely was due to certain unanticipated existence knowledge, it might be as you was in fact economically unsuspecting. In either case, conquering on your own up-over during the last won’t replace your future. All that matters is that you begin procedures to evolve now.

- Regarding maybe not conquering oneself right up, if you find yourself in financial trouble, don’t attempt to repay it too early. One of the primary factors somebody cannot stay away from loans is that they make an effort to pay off their debt too-soon and don’t enjoys an adequate disaster fund.

In place of a crisis fund, the 1st time a car needs a servicing, canine will get ill, or some other the also prominent existence enjoy goes you are obligated to whip out the handmade cards otherwise make an application for private loans to cover the cost.

کانون فرهنگی هنری موعود مسجد امام حسن مجتبی(ع) خورموج تلاش جهت ظهور موعود

کانون فرهنگی هنری موعود مسجد امام حسن مجتبی(ع) خورموج تلاش جهت ظهور موعود